Table Of Content

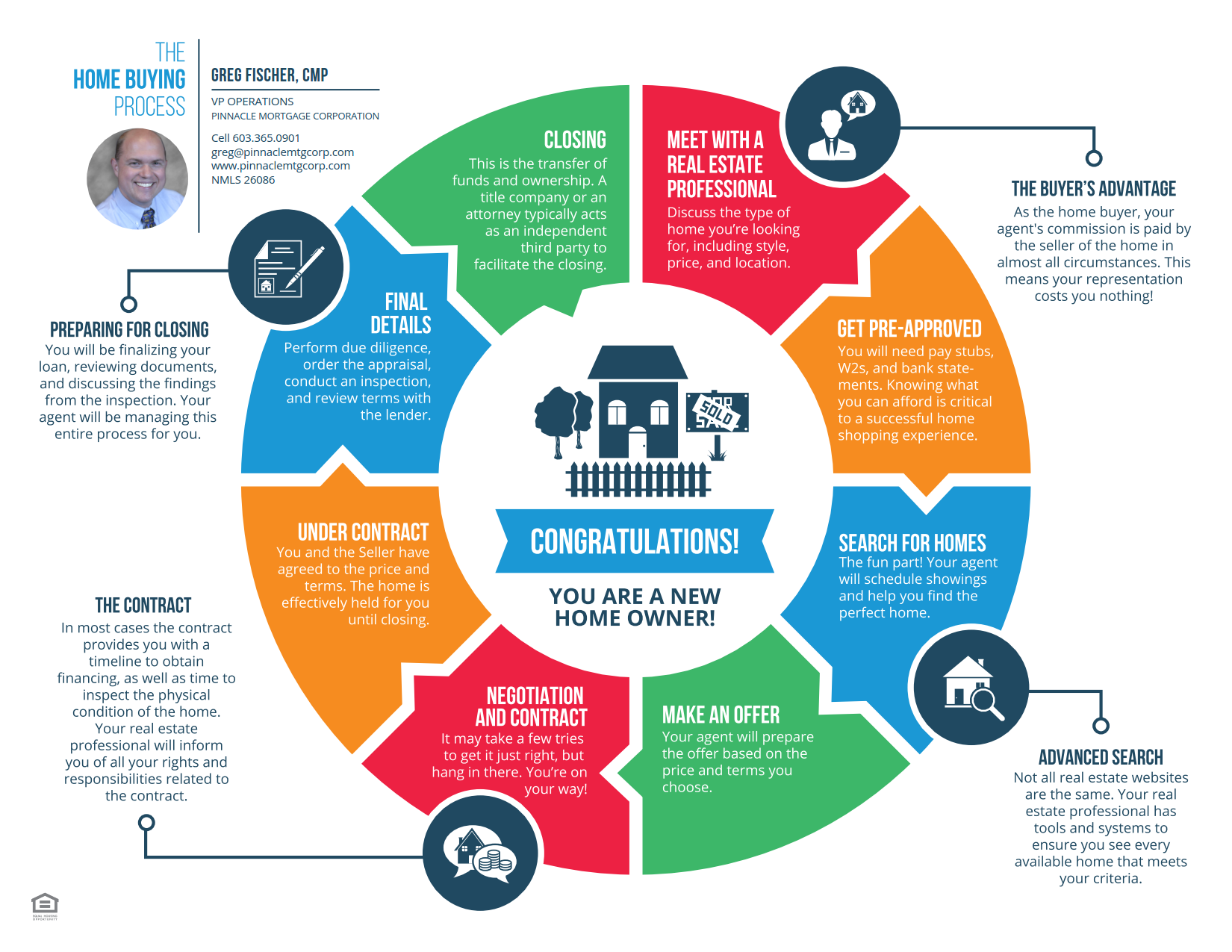

To comfortably afford a typical home, Americans today must have household income of $106,500 — up sharply from $59,000 just four years ago, according to Zillow research. You may be able to buy a house using an FHA loan if you have a 600 credit score. Remember that you’ll be liable for any major repairs after your sale closes. However, if your home inspection reveals an expensive problem (like cracks in the foundation or poorly installed windows), you may want to reconsider the purchase. Once your offer letter is finalized, your agent will contact the seller or the seller’s agent to submit the offer. Your letter will include a deadline for the seller to respond to your offer.

How to Afford a Home

We do not include the universe of companies or financial offers that may be available to you. Ideally, you'll want to have a credit score of 740 or better if you're getting ready to buy a house, since this will help you get a good mortgage rate. But it's possible to buy a house with a much lower score, particularly if you get an FHA loan, which allows scores down to 580 or even 500 with a large down payment. When you decide to make an offer on a home, you must submit an offer letter.

Check your credit score

But in general, a lower score means you might find it harder to get approved for a mortgage, and you likely won't have access to the best rates. The specific closing costs will depend on your loan type, your lender and where you live. Most homeowners will pay for items like appraisal fees and title insurance. If you take out a government-backed loan, you’ll typically need to pay an insurance premium or funding fee upfront. The specific amount you’ll pay in closing costs will depend on where you live and your loan type.

Buying a house? In this economy? 9 stories of people pulling it off.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Most offers also contain an earnest money deposit, typically 1% – 3% of the purchase price, which shows the seller you’re serious about purchasing. Your earnest money deposit goes toward your down payment and closing costs if you buy the home. If you agree to the home sale and later cancel, you’ll typically lose your deposit.

Don’t open new credit lines or make any major purchases until the paperwork is signed, and avoid changing jobs before closing too, if possible. While LA is the opposite of “bargain,” there are pockets where you can find a cheaper place to call home. Redfin’s data shows that living in downtown Los Angeles comes with a lower price tag – $625,000 as of September – and there are other cost-effective suburbs to consider, such as Baldwin Park and Montebello. Of course, if money isn’t an issue for you, you can get closer to the water by exploring Marina del Rey, Brentwood, Venice, Santa Monica and other high-priced spots within a quick jog of the Pacific Ocean. Beaches, mountains, cosmopolitan energy, cultural institutions and a thriving food scene, all dusted with Hollywood-style sophistication and glam – there are so many reasons to love living in Los Angeles.

Ultimately, the right time to buy a home depends on your unique situation. With so many considerations to weigh in potential properties, here are some red flags to look out for when buying a house, especially during the viewing. Find out how property taxes are calculated and which exemptions you might qualify for to reduce your tax bill. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How prepared are you for extra costs?

The impact of inflation and fast-rising interest rates dampened buyers’ interest, causing sales to slow and price appreciation to decelerate. On your closing date the money has been exchanged and the title is now in your name. A title company or real estate attorney will close the transaction and you will typically get the keys after 5 p.m. Depending on if your house is turnkey ready or not, there might be some maintenance and remodeling you want to complete before moving in.

Read over your inspection results with your agent and ask whether they noticed any major red flags. Begin by asking family members and friends for recommendations to find a good real estate agent. Direct referrals are often the best way to get unbiased information on agents in your area. Many states offer down payment assistance programs to qualified buyers, so research whether any assistance is available to make your home purchase more affordable. The amount you’ll need for a down payment depends on your loan type and how much you borrow. If a down payment is required, you can buy a home with as little as 3% down (although putting down more has benefits).

What kind of house will $600K get you in Westchester, Rockland, Putnam? We checked

Let’s take a closer look at what each step involves and what you’ll do along the way. It’s critical to know what to look for when buying a house so you enter the process with clarity and purpose. Having criteria for your dream home and neighborhood could mean the difference between finding the right fit—or making a mistake. A final walk-through is your opportunity to view the property one last time before it becomes yours. This is your last chance to address any outstanding issues before the house becomes your responsibility.

With a higher credit score, you’ll likely qualify for a lower interest rate. If you find that your credit score is lower than you anticipated, you can research how to increase your credit score quickly so you can start house shopping. When you’re ready to start house hunting or if you’ve found a home you want to buy, it’s time to get preapproved for a mortgage.

Your payment history is the factor that has the biggest influence on your credit score. Building a consistent history of on-time payments will always be a surefire way to improve your score. The first step to improving your score is finding out where you stand. You can currently check your credit report for free once every week with all three major credit bureaus (TransUnion, Equifax, and Experian) at AnnualCreditReport.com.

'The Worst House on the Block': Here's Why This Couple Bought a Fixer-Upper Victorian - Realtor.com News

'The Worst House on the Block': Here's Why This Couple Bought a Fixer-Upper Victorian.

Posted: Sat, 27 Apr 2024 10:12:22 GMT [source]

Whether you should buy a house now or wait ultimately depends on your finances and market conditions. While you might consider current mortgage rates ideal, you might benefit from waiting to build credit or saving for a bigger down payment. Speak with a lender or real estate agent before making the decision to buy this year or wait. The down payment is often considered the biggest homebuying expense, since it’s a large amount that the buyer has to actually pay upfront. But homeownership involves plenty of additional costs that you should be ready for.

DTI is calculated by dividing your total monthly debt by your gross monthly income, then multiplying this number by 100 to get a percentage. Your lender will use the debts shown on your credit report to calculate your DTI. Your credit score will help you determine your financing options; lenders use it (among other factors) to set the terms and rates of your loan. The higher your score, the lower the interest rate you will be eligible for — lower scores equate to more expensive mortgages. Last year may go down in real estate history as the year of correction. After a pandemic-fueled, seller-benefitting boom — with bidding wars, inventory shortages and spiraling prices all over the country — the housing market began to cool down in 2022.

Unfortunately, the process isn’t always so straightforward or timely, insurance companies are slow to pay or a mortgage lender buries homeowners in red tape. Since we were uninsured renters, a former co-worker started a GoFundMe for us, a common go-to for people and families who have recently experienced disasters. Cuevas’s boss at the University of San Diego connected the couple with a real estate agent, who set them up with a mortgage lender.

In 2021, they used a combination of their personal savings and a first-time home buyer loan to buy their first property together — a multifamily building that they fixed up and rent out. He previously worked as a reporter for the Omaha World-Herald, Newsday and the Florida Times-Union. His reporting primarily focuses on the U.S. housing market, the business of sports and bankruptcy.